Customer Cash-in Reconciliation

Match invoices with bank inflows automatically, and get real-time visibility on what’s paid.

Introduction

CEOs and finance teams often struggle to know which customer invoices have been paid because payment data is scattered between contracts, invoices, and bank feeds.

Phacet automates cash-in tracking using intelligent labeling and reconciliation, helping teams match incoming payments with expected amounts without manual checks.

When to use this Phacet

Perfect for startup CEOs, FP&A analysts or SMB CFOs who want to:

• Match customer invoices with actual payments

• Eliminate Excel-based reconciliation

• Monitor cash-in in real time and identify late or missing payments

AI skills involved

Automatically classify rows, transactions or documents using predefined or dynamic categories. Label supplier payments, categorize expenses, tag revenue streams Phacet learns with just a few examples.

Automatically match rows across files, systems or formats: invoices vs. payments, contracts vs. invoices, bank lines vs. accounting entries. Phacet supports fuzzy logic, partial matches and multi-criteria rules.

Automatically detect inconsistencies, missing links, or outliers across your data. Phacet spots suspicious values (e.g. duplicate invoices, wrong amounts, unexpected suppliers) without predefined rules.

Review, correct and approve Phacet results manually and improve its intelligence over time. Users can intervene on any field or classification suggested by the AI. Every correction is stored as an example to refine Phacet’s behavior on similar documents and workflows.

→ Ideal for continuous learning loops and maintaining full control in production.

Business impact

Save 90% of time

Eliminate manual Excel checks - focus only on exceptions.

Reliable cash visibility

Track incoming payments in real time for accurate forecasting.

Alerts on late or missing payments

Get notified of unmatched or partial payments with full audit trail.

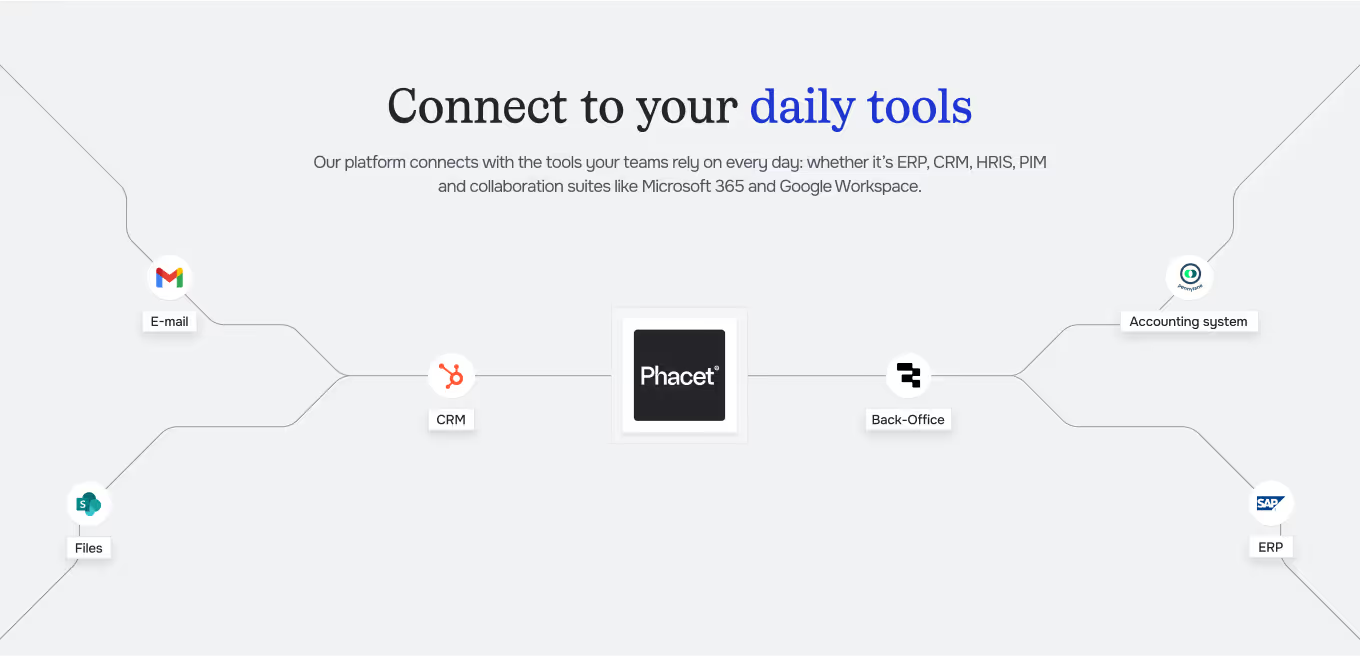

Integrated with everything

“We used to track customer payments in Excel. With Phacet, we just validate what hasn’t matched everything else is done automatically.”

— Request Finance, CFO

Steps to get Started

Connect your systems

Link your accounting or invoicing tool (e.g. Pennylane) and your bank accounts (Qonto, Stripe, Bridge).

Import your invoices

Upload customer invoices or contract data to establish expected amounts.

Match automatically

Phacet suggests matches between bank inflows and issued invoices, flagging partial or unmatched payments.

Review & act

Validate standard cases instantly, escalate anomalies, and keep an audit trail for full control.

Unlock your AI potential

Do more with your existing resources using tailored AI solutions.

Frequently Asked Questions

Phacet connects your bank accounts and invoicing tools to automatically match incoming transactions with issued invoices. The AI flags missing, partial, or delayed payments in real time.

No. Phacet removes the need for Excel. All reconciliations and payment tracking are automated, with real-time updates and full human supervision when needed.

Yes. Phacet integrates seamlessly with ERP and invoicing systems such as Pennylane, Quickbooks, Request Finance, Netsuite, and others via API or file import.

Yes. The intelligent matching engine spots partial or late payments and flags them for review or follow-up actions.

Phacet saves up to 90% of manual tracking time, improves cash flow visibility, and significantly reduces payment delays and bad debts.

Absolutely. Phacet can send automatic alerts for overdue or missing payments, helping teams react quickly and maintain healthy cash flow.